Page 33 - Craftcil Mar-Aor 2025

P. 33

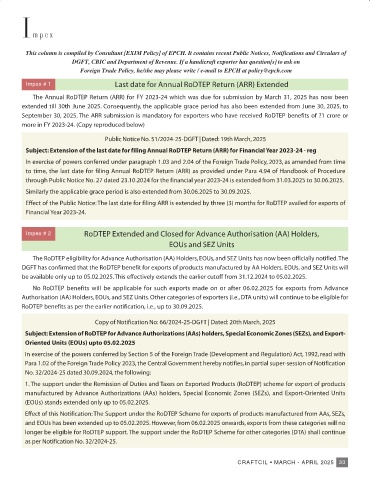

I mpex

This column is compiled by Consultant [EXIM Policy] of EPCH. It contains recent Public Notices, Notifications and Circulars of

DGFT, CBIC and Department of Revenue. If a handicraft exporter has question[s] to ask on

Foreign Trade Policy, he/she may please write / e-mail to EPCH at policy@epch.com

Impex # 1 Last date for Annual RoDTEP Return (ARR) Extended

The Annual RoDTEP Return (ARR) for FY 2023-24 which was due for submission by March 31, 2025 has now been

extended till 30th June 2025. Consequently, the applicable grace period has also been extended from June 30, 2025, to

September 30, 2025. The ARR submission is mandatory for exporters who have received RoDTEP benefits of ?1 crore or

more in FY 2023-24. (Copy reproduced below)

Public Notice No. 51/2024-25-DGFT | Dated: 19th March, 2025

Subject: Extension of the last date for filing Annual RoDTEP Return (ARR) for Financial Year 2023-24 - reg

In exercise of powers conferred under paragraph 1.03 and 2.04 of the Foreign Trade Policy, 2023, as amended from time

to time, the last date for filing Annual RoDTEP Return (ARR) as provided under Para 4.94 of Handbook of Procedure

through Public Notice No. 27 dated 23.10.2024 for the financial year 2023-24 is extended from 31.03.2025 to 30.06.2025.

Similarly the applicable grace period is also extended from 30.06.2025 to 30.09.2025.

Effect of the Public Notice: The last date for filing ARR is extended by three (3) months for RoDTEP availed for exports of

Financial Year 2023-24.

Impex # 2 RoDTEP Extended and Closed for Advance Authorisation (AA) Holders,

EOUs and SEZ Units

The RoDTEP eligibility for Advance Authorisation (AA) Holders, EOUs, and SEZ Units has now been officially notified. The

DGFT has confirmed that the RoDTEP benefit for exports of products manufactured by AA Holders, EOUs, and SEZ Units will

be available only up to 05.02.2025. This effectively extends the earlier cutoff from 31.12.2024 to 05.02.2025.

No RoDTEP benefits will be applicable for such exports made on or after 06.02.2025 for exports from Advance

Authorisation (AA) Holders, EOUs, and SEZ Units. Other categories of exporters (i.e., DTA units) will continue to be eligible for

RoDTEP benefits as per the earlier notification, i.e., up to 30.09.2025.

Copy of Notification No: 66/2024-25-DGFT | Dated: 20th March, 2025

Subject: Extension of RoDTEP for Advance Authorizations (AAs) holders, Special Economic Zones (SEZs), and Export-

Oriented Units (EOUs) upto 05.02.2025

In exercise of the powers conferred by Section 5 of the Foreign Trade (Development and Regulation) Act, 1992, read with

Para 1.02 of the Foreign Trade Policy 2023, the Central Government hereby notifies, in partial super-session of Notification

No. 32/2024-25 dated 30.09.2024, the following:

1. The support under the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme for export of products

manufactured by Advance Authorizations (AAs) holders, Special Economic Zones (SEZs), and Export-Oriented Units

(EOUs) stands extended only up to 05.02.2025.

Effect of this Notification: The Support under the RoDTEP Scheme for exports of products manufactured from AAs, SEZs,

and EOUs has been extended up to 05.02.2025. However, from 06.02.2025 onwards, exports from these categories will no

longer be eligible for RoDTEP support. The support under the RoDTEP Scheme for other categories (DTA) shall continue

as per Notification No. 32/2024-25.

CRAFTCIL • MARCH - APRIL 2025 33